A Complete Guide to Income Tax Return Filing Online: Steps, Deadlines, and Login Info

A Complete Guide to Income Tax Return Filing Online: Steps, Deadlines, and Login Info

In this detailed blog, we’ll walk you through everything about e-filing of income tax returns, including the income tax return filing last date, how to login to the portal, and a step-by-step guide to file income tax return online.

🌐 What is Income Tax Return Filing?

Income tax return filing is the process of submitting a report of your income and taxes paid during a financial year to the Income Tax Department of India. The purpose is to assess tax liabilities, calculate refunds (if applicable), and remain tax-compliant.

🗓️ Income Tax Return Filing Last Date [FY 2024–25]

One of the most searched queries is about the income tax return filing last date. For the financial year 2024–25 (Assessment Year 2025–26):

- For individual taxpayers (non-audit cases): July 31, 2025

- For audit cases: October 31, 2025

- For transfer pricing cases: November 30, 2025

Late filing of ITR can attract penalties up to ₹5,000 under Section 234F of the Income Tax Act.

🔐 Income Tax Return Filing Login Process

To begin with e-filing of income tax return, you need to login to the income tax e-filing portal:

Steps to login:

1. Visit the official income tax e-filing portal.

2. Click on the “Login” button on the top right.

3. Enter your PAN as the user ID.

4. Enter your password and captcha.

5. If you’re a first-time user, click on Register and follow the instructions.

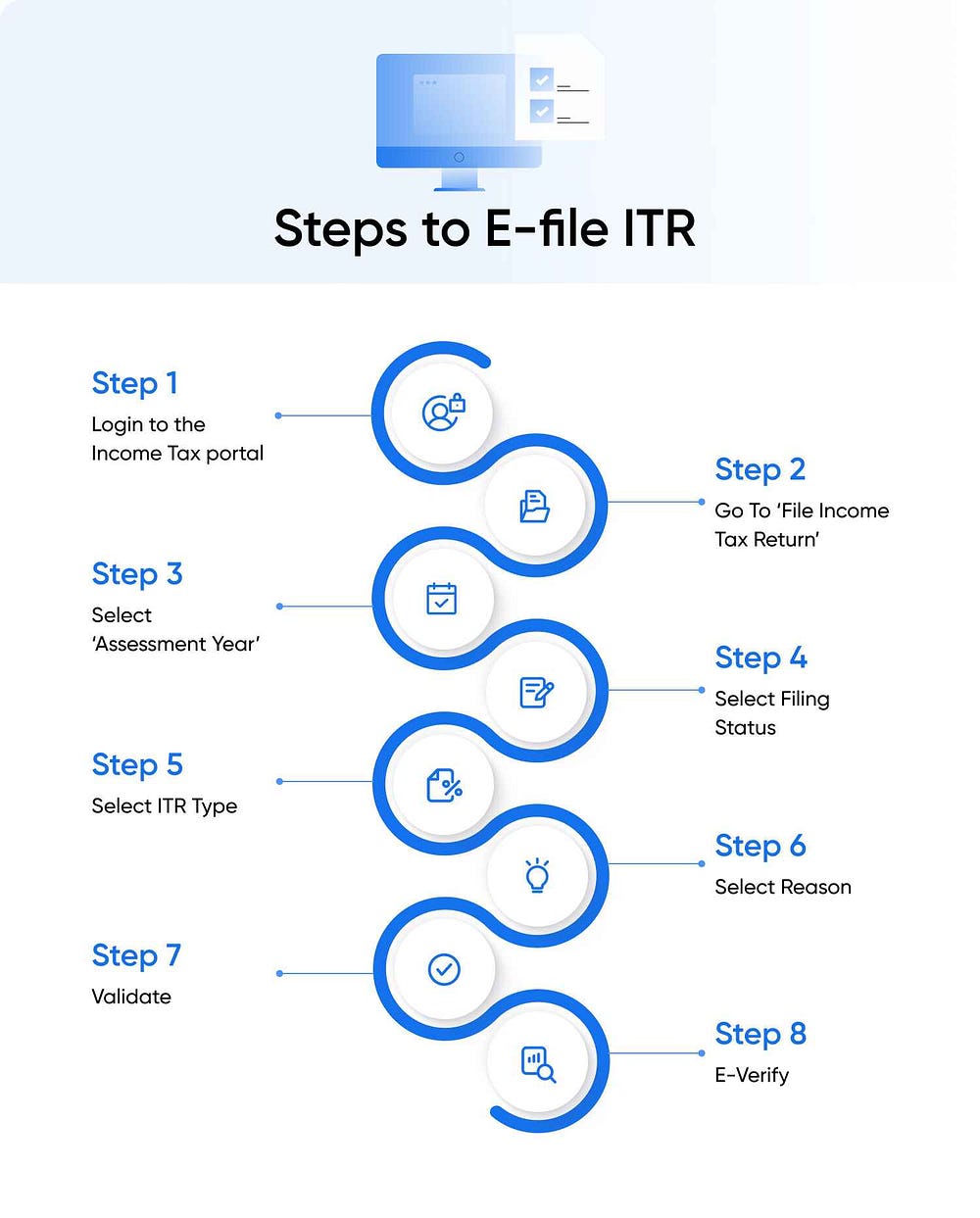

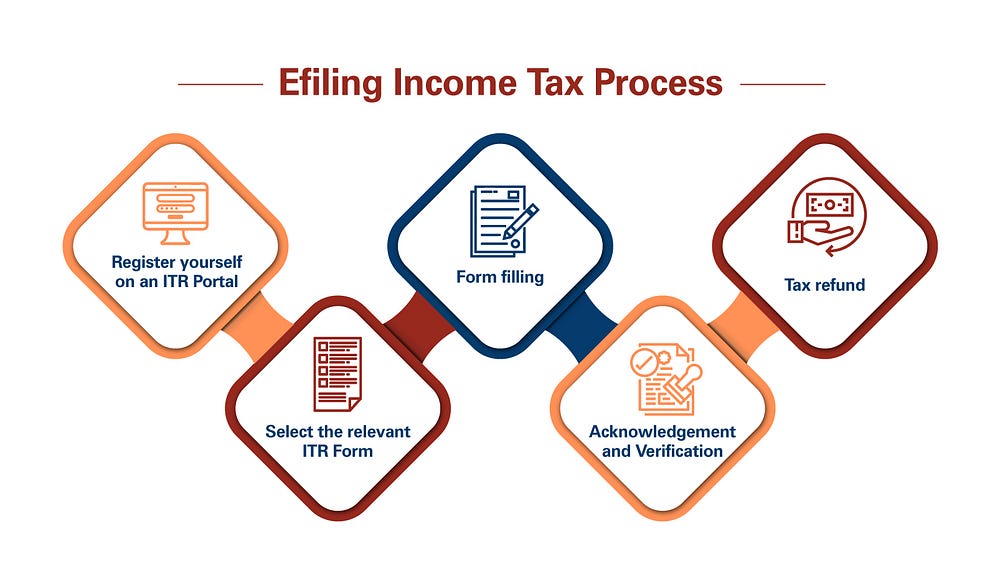

📃 How to File Income Tax Return Online Step by Step

Here’s a step-by-step guide to file income tax return online for salaried and non-salaried individuals:

Step 1: Login to Income Tax e-Filing Portal

Visit incometax.gov.in and use your PAN and password to login.

Step 2: Go to ‘e-File’ → ‘Income Tax Return’

Click on ‘e-File’, then select ‘Income Tax Return’.

Step 3: Select the Assessment Year

Choose the Assessment Year (e.g., AY 2025–26 for FY 2024–25).

Step 4: Choose the Appropriate ITR Form

Based on your income source:

- ITR-1 (Sahaj): Salaried individuals with income up to ₹50 lakhs

- ITR-2: If you have capital gains or foreign assets

- ITR-3: For business or profession income

- ITR-4 (Sugam): Presumptive income scheme users

Step 5: Choose Filing Type

Select ‘Online’ as your mode of filing.

Step 6: Fill in the Required Details

Provide details such as:

- Salary, interest, rental income

- Tax deductions (Section 80C, 80D, etc.)

- TDS details (from Form 26AS)

Step 7: Validate Your Return

Use the ‘Validate’ option to check for errors.

Step 8: Submit and Verify Your Return

You can verify your return through:

📌 Benefits of E Filing of Income Tax Return

- ✅ Faster Processing of Refunds

- ✅ Paperless and Hassle-free Filing

- ✅ Easy Access to Previous Returns

- ✅ Helps in Visa Applications and Loan Approvals

- ✅ Avoid Penalties for Non-Compliance

❗ Common Mistakes to Avoid

- Entering incorrect bank details for refund

- Not verifying your return after submission

- Selecting wrong ITR form

- Mismatch in TDS and Form 26AS data

- Ignoring exempt incomes like PPF or interest from savings

🧾 Documents Required for ITR Filing

Before starting the filing process, keep the following documents ready:

- PAN Card and Aadhaar Card

- Form 16 from employer

- Form 26AS (tax credit statement)

- Interest certificates (FD, savings account)

- Capital gains statement (if applicable)

- Investment proof for deductions

- Bank account details

🤖 New Updates in Income Tax Return Filing for AY 2025–26

- Pre-filled ITR forms with salary, interest income, and TDS details

- New AIS (Annual Information Statement) for income tracking

- Option to choose between old and new tax regimes

- Improved user dashboard on the new e-filing portal

📈 Why Timely Income Tax Return Filing Matters

1. Avoid Late Fees: Save yourself from ₹1,000 to ₹5,000 penalty.

2. Claim Refunds: Excess TDS can only be claimed through ITR.

3. Loan & Visa Applications: ITR proofs are often mandatory.

4. Carry Forward Losses: File ITR on time to carry forward losses.

💼 Professional Help for ITR Filing

If you are confused about how to file income tax return online, consider hiring a CA or a tax consultant. Many platforms like ClearTax, Tax2win, and myITreturn also offer expert-assisted filing.

🏁 Conclusion

With digitization, income tax return filing online has become more accessible and faster. Whether you’re a salaried person or a freelancer, it’s crucial to stay informed about the income tax return filing last date and use the correct method to file your return.

If you haven’t filed your ITR yet, now is the time! Don’t wait for the deadline rush. Make use of the easy e filing of income tax return facility and stay compliant.

✅ Frequently Asked Questions (FAQs)

Q1. What is the last date for income tax return filing for AY 2025–26?

A: July 31, 2025, for individual taxpayers.

Q2. How do I check my ITR status?

A: Login to the e-filing portal, go to Dashboard → View Filed Returns.

Q3. Is it mandatory to verify ITR?

A: Yes, ITR is incomplete until it is verified.

Q4. Can I revise my ITR after submission?

A: Yes, revised returns can be filed before December 31, 2025.

Q5. Can I file ITR without Form 16?

A: Yes, use salary slips and Form 26AS to compute income.

Contact Us

To know more about ITR filing ,pricing, or to book a site visit, get in touch with us today:

📞 Call: 9899767300

📧 Email: info@realtaxindia.com

🌐 Website: https://realtaxindia.com/

Comments

Post a Comment