Simple Guide to Income Tax Return Filing in India

✅ Simple Guide to Income Tax Return Filing in India | Step-by-Step e-Filing 2025 (realtaxindia.com)

Filing your Income Tax Return (ITR) is an important financial responsibility for every earning individual and business in India. Whether you are a salaried employee, self-employed professional, or a small business owner, e-filing of income tax ensures that your earnings are reported correctly to the government.

In this blog, we will explain everything about Income Tax Return Filing, including how to do it online, who should file it, last dates, benefits, and more — in simple and easy-to-understand.

📌 What is Income Tax Return Filing?

Income Tax Return (ITR) Filing is the process of declaring your total income, expenses, deductions, and taxes paid to the Income Tax Department of India.

When you file ITR, you’re basically informing the government about:

- Your total income during a financial year

- Taxes already paid (like TDS)

- Any tax refund you are eligible for

🔍 Who Should File Income Tax Return?

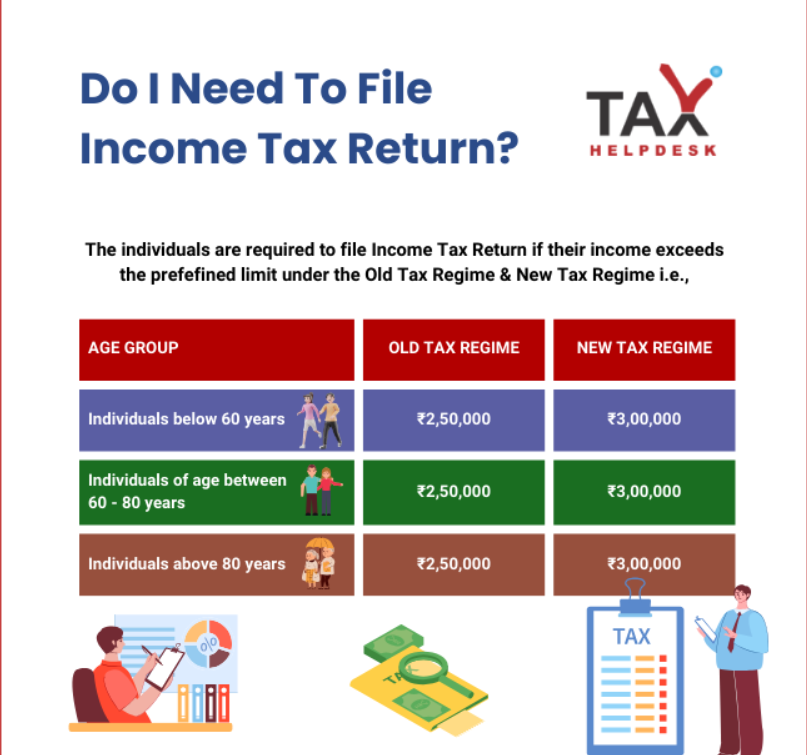

You must file your income tax return if:

- Your total annual income is above ₹2.5 lakhs (for individuals below 60)

- You want to claim a refund

- You want to carry forward losses for future tax benefits

- You have foreign assets or income

- You apply for a loan or visa

Even if your income is below the limit, filing ITR is often a smart move.

📅 Income Tax Return Filing Last Date for AY 2024–25

The last date to file ITR for the Assessment Year (AY) 2024–25 (i.e., Financial Year 2023–24) is usually 31st July 2024 for individuals and non-audit cases.

If your accounts need to be audited, the due date may extend to 31st October 2024.

⏳ Late filing can attract penalties up to ₹5,000, so it’s better to file on time!

🌐 What is e-Filing of Income Tax Return?

Online ITR filing is:

🖥️ Step-by-Step Guide: How to File Income Tax Return Online

Here is a simple step-by-step guide for ITR e-filing:

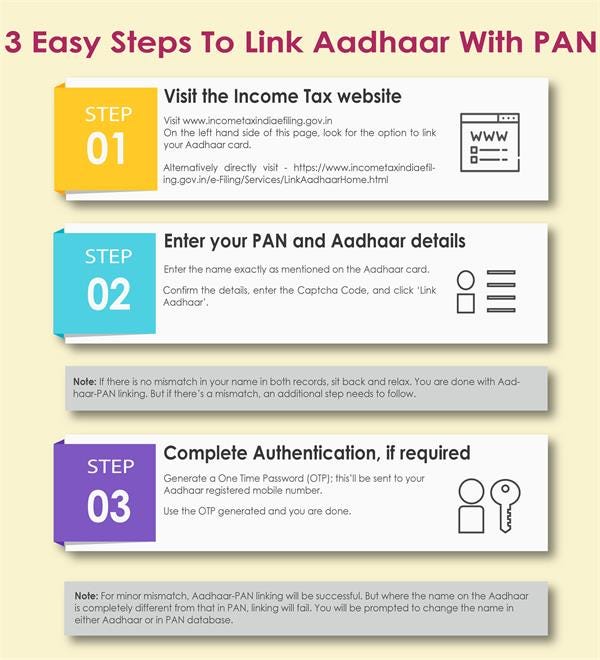

Step 1: Register or Login

- Click on “Login” if already registered

- Or click on “Register” using your PAN, email & phone

Step 2: Choose “File Income Tax Return”

- Go to ‘e-File’ → ‘Income Tax Return’ → ‘File Income Tax Return’

- Select Assessment Year (e.g., AY 2024–25)

Step 3: Choose Filing Type

- Online Mode: Best for most users

- Select whether filing as individual, HUF, or others

Step 4: Choose ITR Form

Common ITR Forms:

- ITR-1 (Sahaj): For salaried individuals

- ITR-2: For people with income from capital gains or foreign income

- ITR-3: For business/professional income

- ITR-4 (Sugam): For small businesses opting for presumptive income

Choose the correct ITR form based on your income source.

Step 5: Fill Details

- Income details (salary, house property, business)

- Deductions under Section 80C to 80U (LIC, PPF, NPS, etc.)

- Bank account details

- Tax paid and TDS details

Step 6: Preview and Submit

- Check all data

- Submit your ITR

- Verify it using OTP, Aadhaar, Net Banking, or DSC

🧾 Documents Required for ITR Filing

Here are the documents you may need:

- PAN Card & Aadhaar Card

- Form 16 (for salaried)

- Salary Slips

- Interest certificates from bank/post office

- Form 26AS (TDS summary)

- Investment proofs (LIC, PPF, ELSS, etc.)

- Home loan certificate (if applicable)

✅ Benefits of Filing Income Tax Return

- ✔️ Avoid penalties for non-filing

- ✔️ Claim tax refunds easily

- ✔️ Helps in loan approval or visa processing

- ✔️ Acts as proof of income

- ✔️ Carry forward losses to future years

- ✔️ Maintain financial credibility

🧩 What is the Income Tax e-Filing Portal?

The Income Tax India e-Filing Portal is the official platform launched by the government for all tax-related services:

- File returns

- Download ITR forms

- Track refund status

- E-verify ITR

- View Form 26AS

👉 Link: https://www.incometax.gov.in

Make sure to login regularly to check updates or notices.

💡 Common Mistakes to Avoid While Filing ITR

- ❌ Using the wrong ITR form

- ❌ Not reporting all sources of income

- ❌ Forgetting to claim deductions

- ❌ Providing wrong bank details

- ❌ Not verifying the ITR after submission

Note: Always double-check details to avoid notices or rejection.

📈 Why is Income Tax e-Filing Important?

- Promotes transparenc

- Easy to track income and tax liability

- Helps the government in nation-building

- Allows quick and easy refund processing

🧠 FAQs — Income Tax Return Filing

Q1. Is filing ITR compulsory?

If your income is above ₹2.5 lakh per year (₹3 lakh for senior citizens), yes, it’s mandatory.

Q2. Can I file ITR without Form 16?

Yes, you can. Use salary slips and Form 26AS to file your return.

Q3. What happens if I miss the ITR filing deadline?

You can still file a belated return by 31st December with a penalty.

Q4. How do I check my ITR refund status?

Login to the e-filing portal → ‘View Returns/Forms’ → Check refund status

File Your ITR with Expert Help from Real Tax India

Don’t let confusion delay your filing. Trust Real Tax India to file your income tax return on time and with accuracy. Whether you’re salaried, a freelancer, or a business owner, we’ve got you covered!

📞 Call: 9899767300

📧 Email: info@realtaxindia.com

🌐 Website: https://realtaxindia.com

Comments

Post a Comment