Income Tax India: Slabs, Regimes, Gains, Deductions Guide

Complete Guide to Income Tax in India: Slabs, Regimes, Capital Gains & Deductions Explained

Understanding the Income Tax system in India is crucial for every individual and business. Governed by the Income Tax Act of 1961 and managed by the Central Board of Direct Taxes (CBDT), income tax plays a key role in financing the country’s development through systematic tax collection. Whether you are a salaried employee, business owner, or investor, having clarity on tax laws helps you make smarter financial decisions.

This blog explains the fundamentals of income tax in India, the difference between the old and new tax regimes, tax deductions, capital gains, and more — based on insights from Real Tax India.

📊 Income Tax Slabs in India: Old vs. New Regime

🏛️ Old Regime

The old tax regime is known for its numerous deductions and exemptions that help reduce taxable income. It is a preferred choice for individuals who actively invest in tax-saving instruments like:

- Section 80C deductions (up to ₹1.5 lakh for ELSS, PPF, LIC, etc.)

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

Tax Slabs (Old Regime):

- Up to ₹2.5 lakh: No tax

- ₹2.5 lakh — ₹5 lakh: 5%

- ₹5 lakh — ₹10 lakh: 20%

- Above ₹10 lakh: 30%Senior citizens have higher exemption limits.

🆕 New Regime

Introduced to simplify the tax process, the new tax regime offers lower slab rates but removes most deductions and exemptions.

Tax Slabs (New Regime for FY 2023–24):

- Up to ₹3 lakh: No tax

- ₹3 lakh — ₹6 lakh: 5%

- ₹6 lakh — ₹9 lakh: 10%

- ₹9 lakh — ₹12 lakh: 15%

- ₹12 lakh — ₹15 lakh: 20%

- Above ₹15 lakh: 30%

Standard deduction of ₹50,000 is still available for salaried individuals.

Key Difference:

- Old regime is ideal for those with high investments and expenses.

- New regime is better for those seeking simplicity and low compliance.

For FY 2023–24, the new regime is the default, but taxpayers can still opt for the old regime if it suits them better.

💼 Types of Taxes in India

1. Direct Taxes

Levied directly on an individual’s income or a corporation’s profits. Examples:

- Income Tax

- Corporate Tax

2. Indirect Taxes

Levied on goods and services and paid indirectly by consumers. The most common:

- Goods and Services Tax (GST) — a unified tax replacing multiple indirect taxes like VAT, service tax, and excise.

💰 TDS (Tax Deducted at Source)

TDS is deducted at the point of income generation, such as:

- Salary payments

- Bank interest

- Professional fees

This ensures tax is collected consistently throughout the year and reduces the burden at the end of the financial year.

📆 Advance Tax

If your total tax liability exceeds ₹10,000 in a year, you must pay Advance Tax in four installments. This is especially applicable to:

- Freelancers

- Business owners

- Individuals earning capital gains or rental income

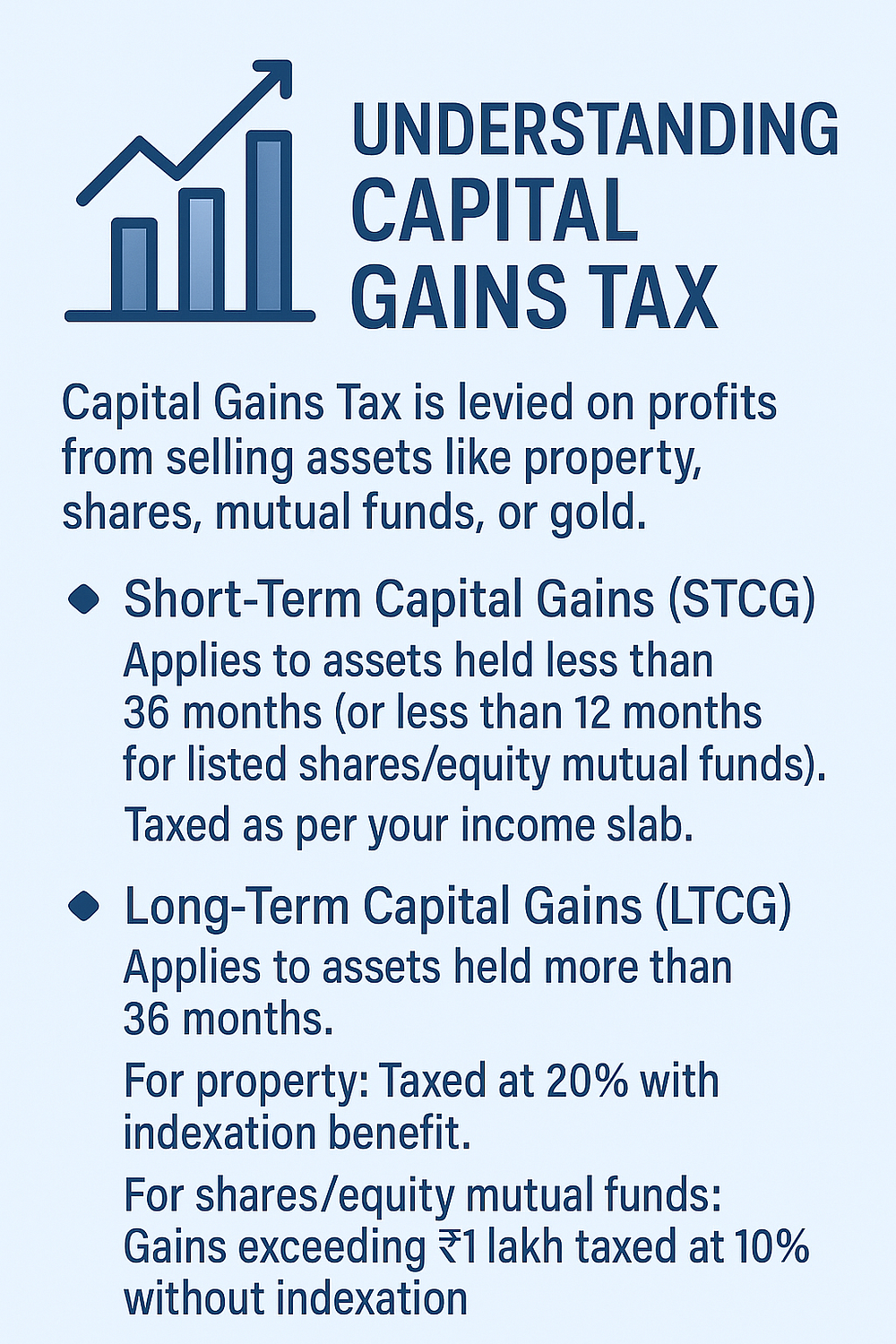

📈 Understanding Capital Gains Tax

Capital Gains Tax is levied on profits from selling assets like property, shares, mutual funds, or gold.

🔹 Short-Term Capital Gains (STCG)

- Applies to assets held less than 36 months (or less than 12 months for listed shares/equity mutual funds).

- Taxed as per your income slab.

🔹 Long-Term Capital Gains (LTCG)

- Applies to assets held more than 36 months.

- For property: Taxed at 20% with indexation benefit.

- For shares/equity mutual funds: Gains exceeding ₹1 lakh taxed at 10% without indexation.

🎯 Benefits of Capital Gains Tax

- Supports Economic Stability

Ensures wealth generated through asset appreciation contributes to the nation’s growth. - Government Revenue

Funds from capital gains tax support public services, infrastructure, and welfare programs. - Encourages Investment

Favorable LTCG provisions promote long-term strategic investments in property and equity. - Planned Investments

Sections like 54 offer exemptions if capital gains are reinvested in residential property, supporting the real estate sector.

📚 Tax Planning Tips for Individuals

- Compare Old vs. New Regime

Choose the one that minimizes your tax liability based on your deductions and income. - Invest in Tax-Saving Instruments

If opting for the old regime, utilize options like ELSS, PPF, NPS, and life insurance. - File on Time

Avoid late filing penalties and ensure refunds by filing before the due date (usually July 31st for individuals). - Use Professional Help

Agencies like Real Tax India offer expert assistance in income tax filing, saving you time and avoiding errors.

📞 Contact Real Tax India for Hassle-Free Tax Filing

If you want help with income tax return filing, investment planning, or tax consultation, reach out to:

📍 Location: Noida, UP — 201301

🌐 Website: www.realtaxindia.com

📧 Email: info@realtaxindia.com

📞 Phone: 9899767300

🔚 Final Thoughts

India’s income tax system may seem complex, but with the right guidance and understanding, it becomes a powerful tool for financial planning. Whether you’re choosing between the old and new regimes, calculating capital gains, or paying advance tax, staying informed is the key to saving money and staying compliant.

Let Real Tax India help you make smarter tax decisions and ensure peace of mind during every financial year.

Comments

Post a Comment