🏡 TDS on Property Purchase in India

🏡 TDS on Property Purchase in India: Everything You Need to Know

By Realtaxindia| 20 JUN 2025 | 5 min read

When buying property in India, many homebuyers overlook a critical compliance step — Tax Deducted at Source (TDS). While it may seem like a bureaucratic formality, TDS plays a vital role in ensuring tax transparency and avoiding future penalties. This guide breaks down the entire process, from applicability to payment, in a simple, actionable format.

📌 What Is TDS and Why Is It Important?

TDS is a tax collection mechanism where a portion of the payment is deducted at the source and deposited with the government. It applies to various transactions — salaries, rent, professional fees — and yes, even property purchases. For the Income Tax Department, TDS is a way to track high-value transactions and ensure tax compliance.

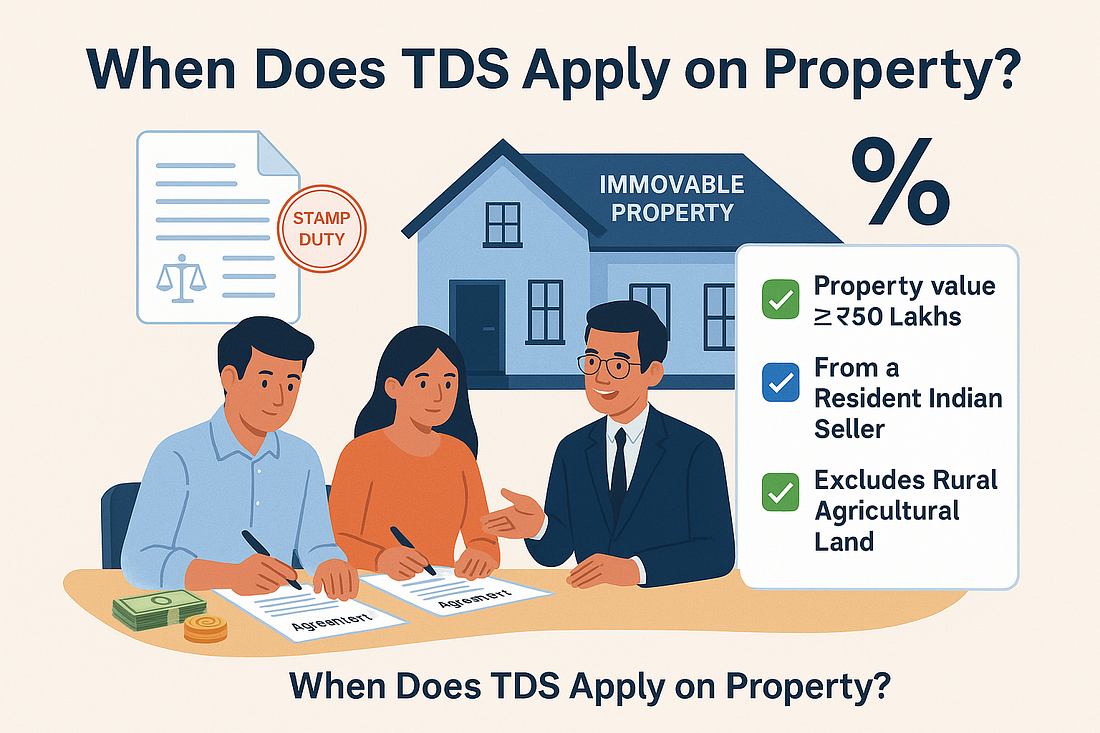

🏠 When Does TDS Apply on Property?

TDS is applicable when:

- You purchase an immovable property (excluding rural agricultural land)

- From a resident Indian

- For a value of ₹50 lakhs or more, based on either the agreement value or the stamp duty value — whichever is higher

This rule ensures that large property transactions are reported and taxed appropriately.

👥 Joint Buyers: Understanding the ₹50 Lakh Threshold

The ₹50 lakh threshold is per buyer. For example, if two people jointly purchase a property worth ₹96 lakhs, and each owns 50%, then their individual share is ₹48 lakhs — below the threshold. In such a case, TDS is not required.

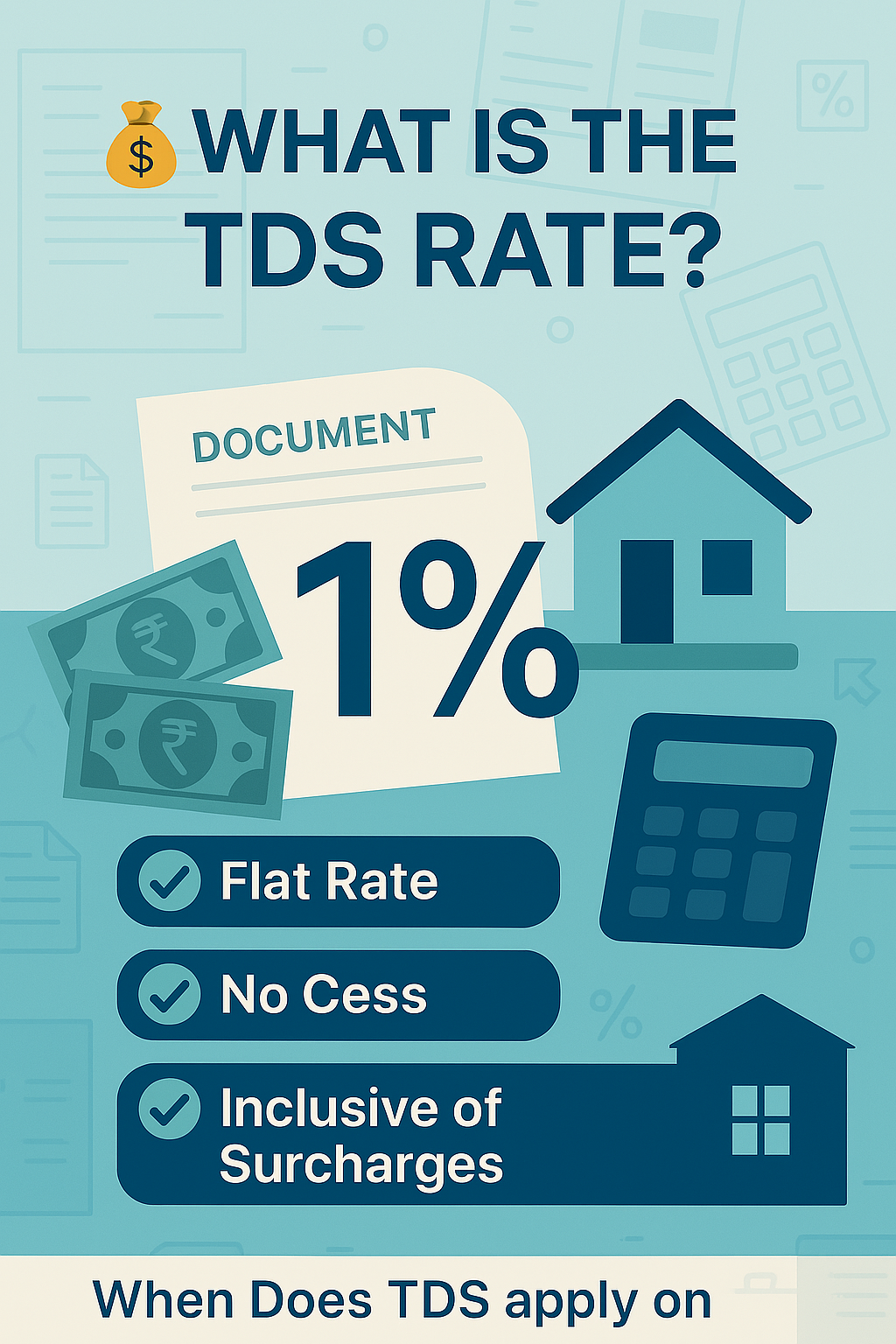

💰 What Is the TDS Rate?

As of now, the TDS rate on property purchases is 1% of the total consideration. This rate is inclusive of all surcharges and cess, regardless of the property value. It’s a flat rate, making it easy to calculate and comply with.

📦 What’s Included in the TDS Value?

TDS is calculated on the total consideration, which includes:

- Agreement value or stamp duty value (whichever is higher)

- Club membership fees

- Parking charges

- Maintenance fees

- Water and electricity charges

- Any other incidental charges mentioned in the agreement

These inclusions were made mandatory from 1 April 2022 to ensure comprehensive tax coverage.

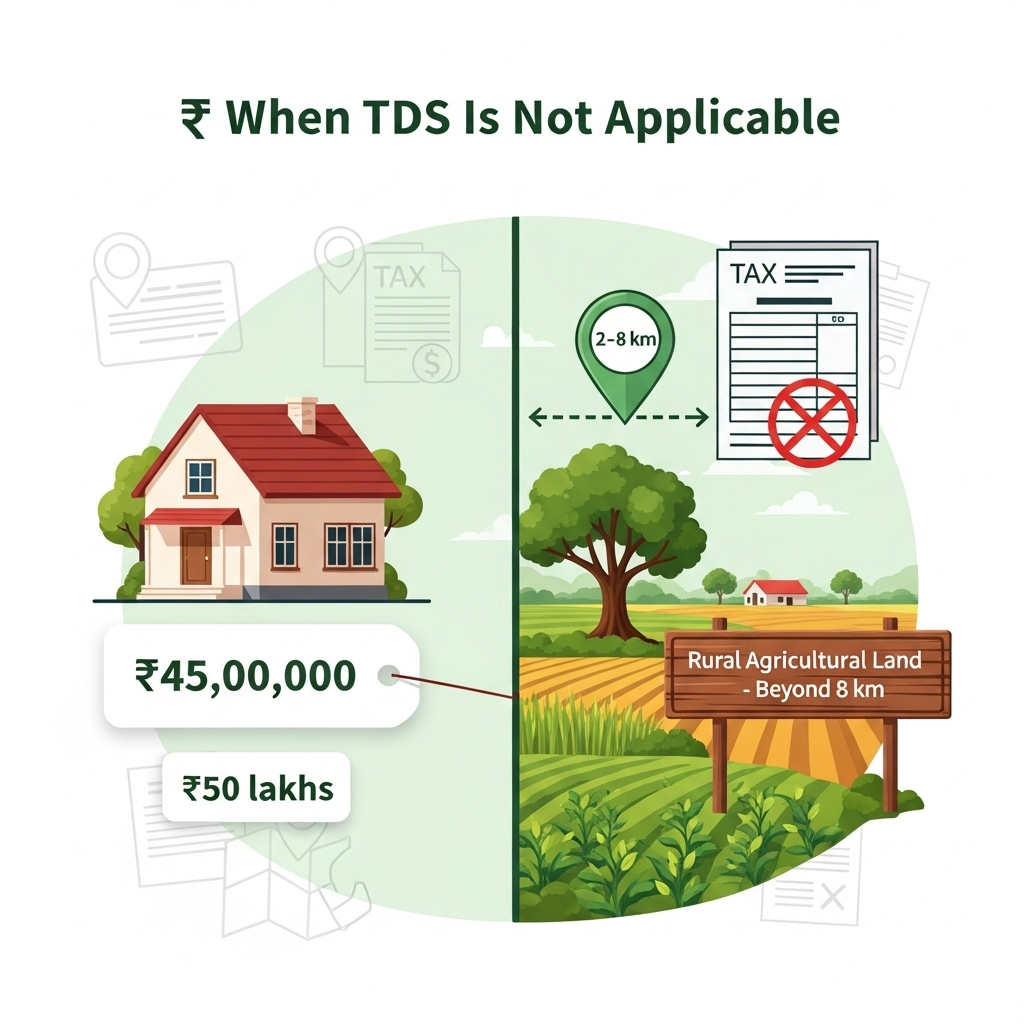

🌾 When TDS Is Not Applicable

TDS is not applicable in the following cases:

- Property value is below ₹50 lakhs

- The property is rural agricultural land, defined as land located beyond 2–8 km from municipal limits, depending on the population of the area

This exemption ensures that small-scale and rural transactions are not burdened with compliance.

⏱️ When to Deduct and Deposit TDS

TDS must be deducted:

- At the time of payment or when the liability is recorded, whichever is earlier

- For under-construction properties, TDS must be deducted on each installment

The deducted TDS must be deposited with the government within 30 days from the end of the month in which it was deducted.

🧾 How to Pay TDS: Form 26QB

To pay TDS, the buyer must file Form 26QB, a challan-cum-statement that captures all transaction details. This form must be submitted before depositing the TDS. It can be filed online through the TIN NSDL portal.

Once filed, the buyer can download Form 16B, which serves as the TDS certificate and must be shared with the seller.

⚠️ Penalties for Non-Compliance

Failing to deduct or deposit TDS on time can lead to:

- Interest: 1.5% per month (or part thereof) for delayed payment

- Penalty: ₹200 per day for late filing of Form 26QB (capped at the TDS amount)

For example, if you deduct TDS on 5th March but file Form 26QB on 30th June, you may be liable for a penalty of ₹12,000 (₹200 × 60 days).

✅ Final Thoughts: Don’t Skip TDS Compliance

TDS on property purchases is not just a formality — it’s a legal obligation. Ignoring it can lead to financial penalties and legal complications. If you’re unsure about the process, consult a qualified tax advisor or let professionals handle it for you.

📞 Need Help with TDS Filing?

Let the experts at Real Tax India simplify the process for you.

🔗 Visit RealTaxIndia.com 📧 Email: info@realtaxindia.com 📍 PAN India Services 📞Call : +91 9899767300

Comments

Post a Comment