🎯 Who is Considered a Freelancer Under Indian Tax Law?

🧾 Income Tax Filing for Freelancers in India: A Complete Guide for 2025

With freelancing becoming the new normal in India, more and more professionals are earning independently through platforms like Upwork, Fiverr, LinkedIn, and direct clients. But here’s the catch: many freelancers aren’t aware of their tax obligations. If you’re a freelancer or gig worker, knowing how to file your income tax correctly is not just important — it’s mandatory.

At RealTaxIndia.com, we simplify freelancer income tax filing with expert guidance, fast service, and complete online support. Whether you’re a designer, writer, developer, influencer, or consultant — this guide is your go-to resource to file your income tax return stress-free in 2025.

🎯 Who is Considered a Freelancer Under Indian Tax Law?

A freelancer is anyone who earns income by offering services independently, without being on an employer’s payroll. This includes:

- Content writers & bloggers

- Graphic & web designers

- Software developers & IT consultants

- Digital marketers & SEO experts

- Online tutors & coaches

- Influencers, vloggers, and social media managers

- YouTubers & affiliate marketers

If you earn ₹2.5 lakhs or more per year, you are required to file an Income Tax Return (ITR).

📝 Which ITR Form Should Freelancers Use?

Freelancers typically need to file ITR-3 or ITR-4, depending on the nature of income:

- ITR-4: If you choose presumptive taxation under Section 44ADA (your income is taxed at 50% of gross receipts and no books are required).

- ITR-3: If you maintain full books of accounts and want to claim actual expenses.

👉 Not sure which form is right? Real Tax India helps you pick the right one based on your work, income, and future plans.

💸 What Income is Taxable for Freelancers?

Your taxable income includes:

- Payments from Indian and foreign clients

- Money earned via online platforms like Fiverr, Upwork, etc.

- Affiliate income or brand deals

- Royalties, ad revenue (YouTube, blogs, etc.)

- Consulting or training fees

💡 Tip: Even foreign remittances received via PayPal, Wise, or bank transfer are taxable in India.

✅ What Deductions Can Freelancers Claim?

To reduce your taxable income, you can claim business-related expenses such as:

- Laptop/computer purchase

- Internet & mobile bills

- Software subscriptions (like Canva, Adobe, etc.)

- Rent (if working from home or co-working space)

- Marketing & advertisement costs

- Domain and hosting charges

- Travel expenses related to work

- Electricity bills (proportionate for home office)

RealTaxIndia helps you identify and legally claim all deductions so that you pay less tax and stay compliant.

🔄 What is Presumptive Taxation Under Section 44ADA?

Under Section 44ADA, if your annual gross receipts are less than ₹75 lakhs, you can opt for presumptive taxation, which means:

- You pay tax on 50% of your income (rest is assumed as expenses)

- No need to maintain books or get audited

- Only ITR-4 is required

This is ideal for most freelancers who want to file faster and avoid compliance burden.

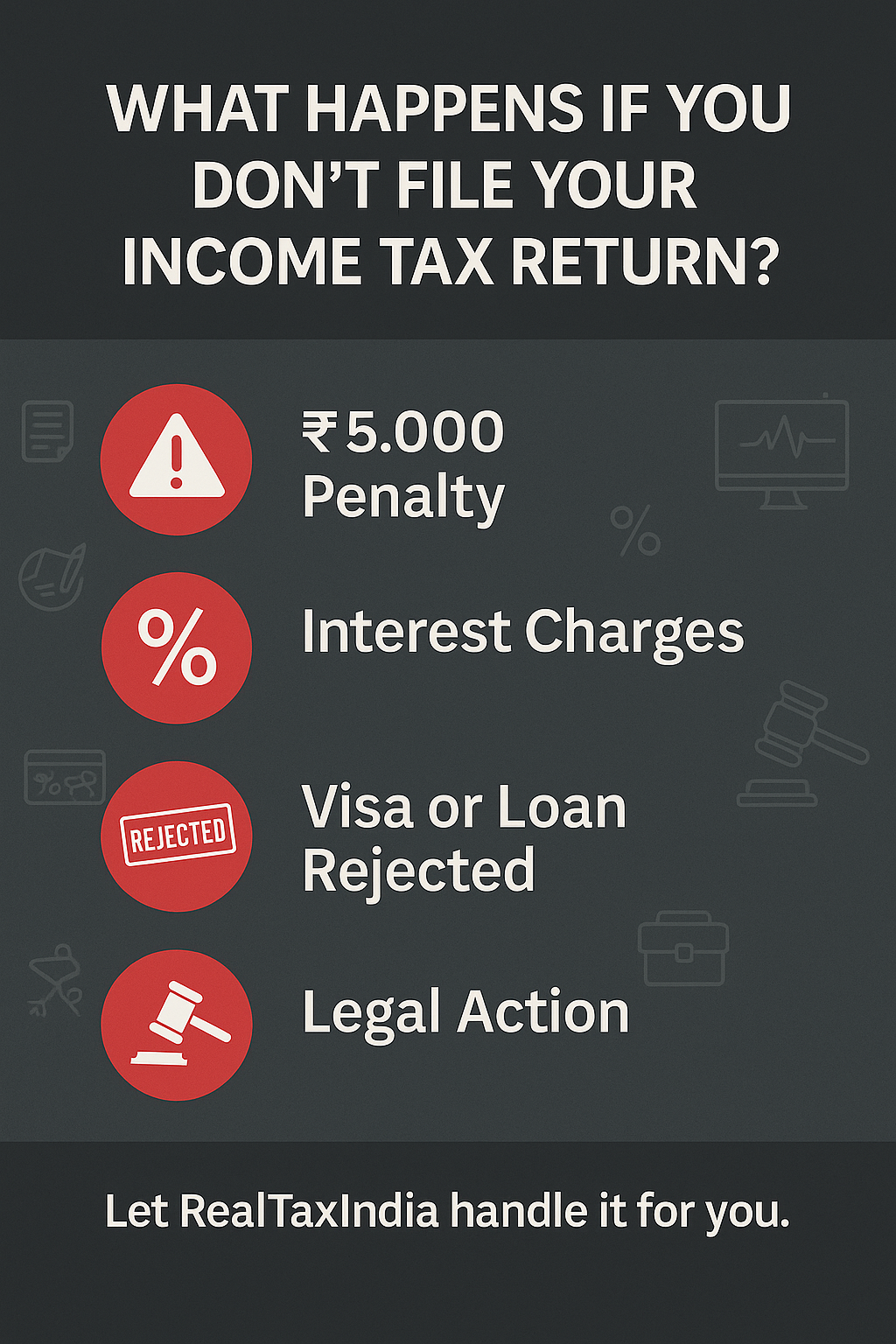

⚖️ What Happens If You Don’t File?

Failing to file your ITR can lead to:

- Penalties up to ₹5,000

- Interest on late payments

- Trouble with getting loans, visas, or credit cards

- Legal action in serious cases

Don’t risk your financial future. Let RealTaxIndia handle it for you.

🧑💼 Why File Through RealTaxIndia?

At RealTaxIndia.com, we make tax filing simple, fast, and accurate for freelancers:

Whether you earn ₹2.5 Lakhs or ₹20 Lakhs+ per year — we handle it all.

📊 What Documents Are Required?

To get started, you just need:

- PAN Card

- Aadhaar Card

- Bank Statements

- Details of income earned

- Expense proof (if claiming deductions

- Form 26AS and AIS/TIS report

You can upload these securely on our website or WhatsApp them to our tax experts.

🔚 Conclusion: Don’t Guess, File Smart

As a freelancer, you work hard for your money — why let poor tax planning reduce your income? With proper filing, smart deductions, and expert support, you can save thousands each year and stay worry-free.

Ready to file your freelance tax return?

- Email: info@realtaxindia.com

- ✅ Trusted by 1,000+ freelancers across India

Comments

Post a Comment