📊 Are Your Mutual Fund Portfolios Overlapping

📊 Are Your Mutual Fund Portfolios Overlapping? Here’s How to Find Out & Fix It

In the world of investments, building a well-diversified mutual fund portfolio is key to managing risks and maximizing returns. However, many investors unknowingly fall into the trap of over-diversification — buying too many mutual funds that hold the same stocks. This creates mutual fund portfolio overlap, which defeats the very purpose of diversification.

So, what exactly is portfolio overlap? Why does it matter? And how can you identify and eliminate it to build a more effective investment strategy? Let’s break it down.

Linkedin : New Post

Facebook : New Post

🔍 What Is Mutual Fund Portfolio Overlap?

Portfolio overlap occurs when two or more mutual funds in your portfolio hold the same stocks. For example, if both Fund A and Fund B have invested 5% in Reliance Industries, that 5% holding is considered an overlap.

This happens more frequently than you think, especially because fund managers often invest in the same top-performing stocks — such as the top 100, which make up nearly 60% of the total equity AUM in the industry.

⚠️ Why Is Portfolio Overlap a Problem?

Here’s why you should take portfolio overlap seriously:

- Reduced Diversification: When funds hold the same stocks, your risk is concentrated instead of spread across various sectors or companies.

- Increased Risk Exposure: If a commonly held stock underperforms, all overlapping funds in your portfolio suffer losses simultaneously.

- Higher Costs: Redundant investments mean paying multiple management fees — without any additional benefit.

- Strategy Misalignment: Overlap can distort your investment strategy, making it harder to achieve your financial goals.

- Linkedin : New Post

- Facebook : New Post

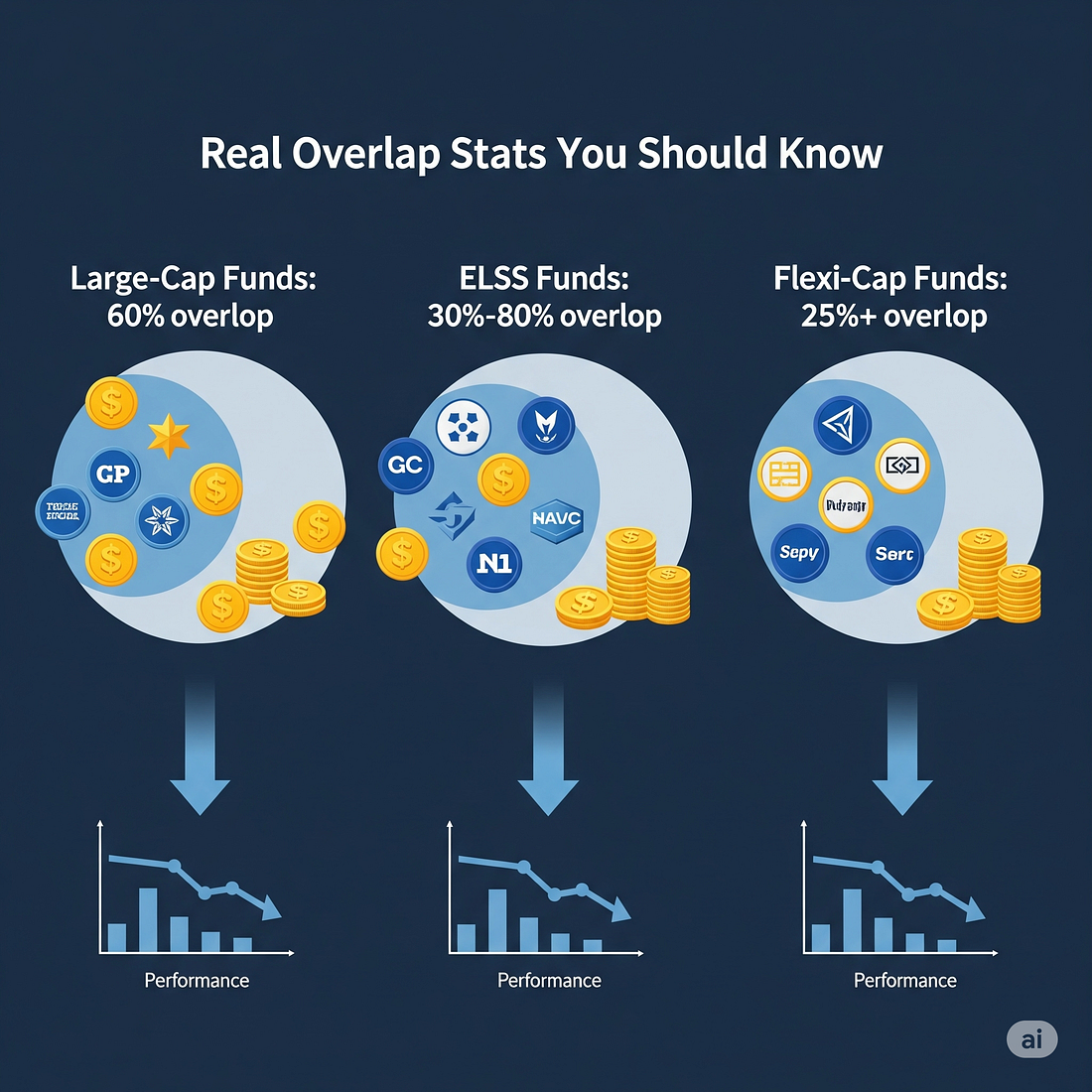

📊 Real Overlap Stats You Should Know

- Large-Cap Funds: Overlap as high as 60%

- ELSS Funds: Overlap ranges from 30% to 80%

- Flexi-Cap Funds: Overlap often exceeds 25%

These overlaps are especially common because mutual fund houses often target the same blue-chip stocks. Over time, such overlaps can lead to underperformance, especially during market volatility.

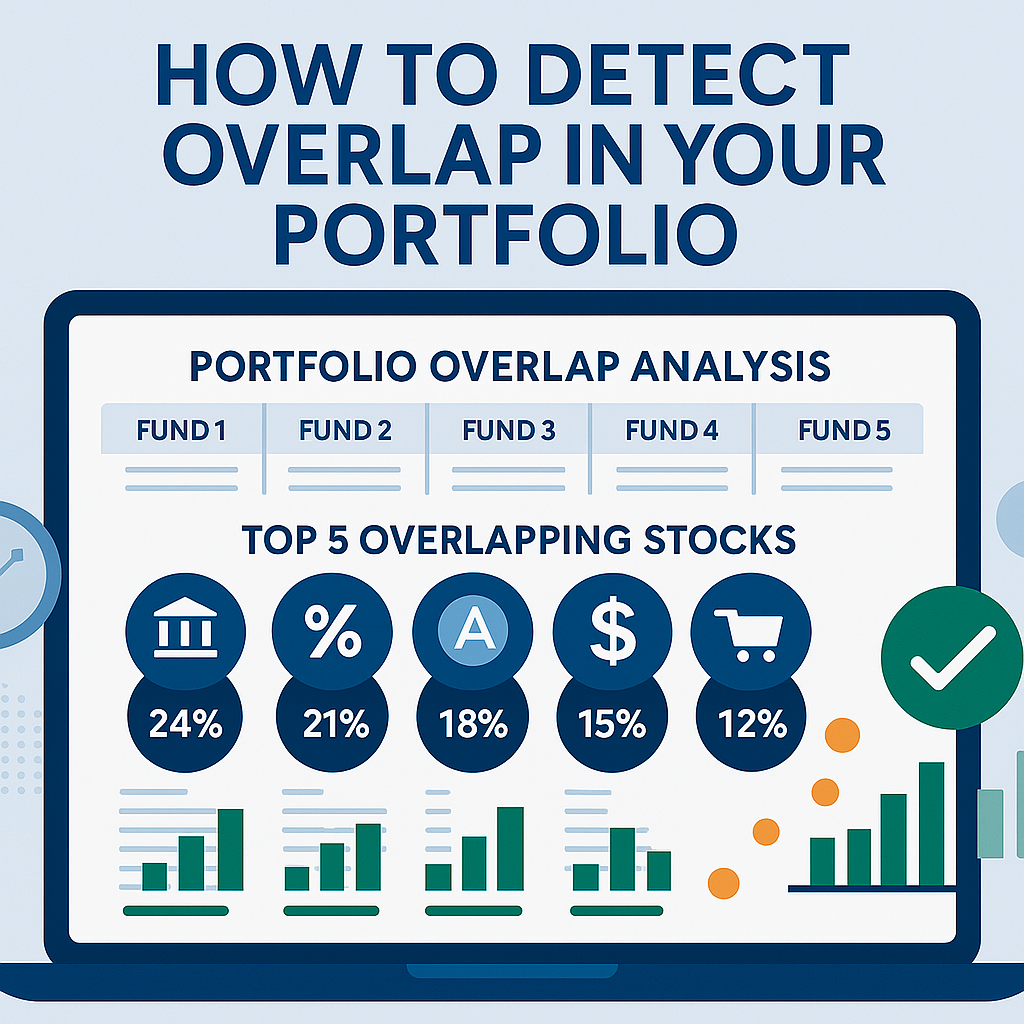

🔧 How to Detect Overlap in Your Portfolio

To identify overlapping holdings, you can manually compare each fund’s top stock allocations — but that’s time-consuming. Instead, use a portfolio overlap analysis tool like the one offered by 1 Finance. It helps you:

- Compare up to 5 mutual funds at once

- View the top 5 overlapping stocks and their weightage

- Understand how diversified (or not) your portfolio really is

- Linkedin : New Post

- Facebook : New Post

Example:

Let’s say you’re holding:

Once entered into the tool, you’ll see overlap percentages — like 57% overlap between HDFC Top 100 and ICICI Prudential Bluechip Fund — clearly indicating the need for rebalancing.

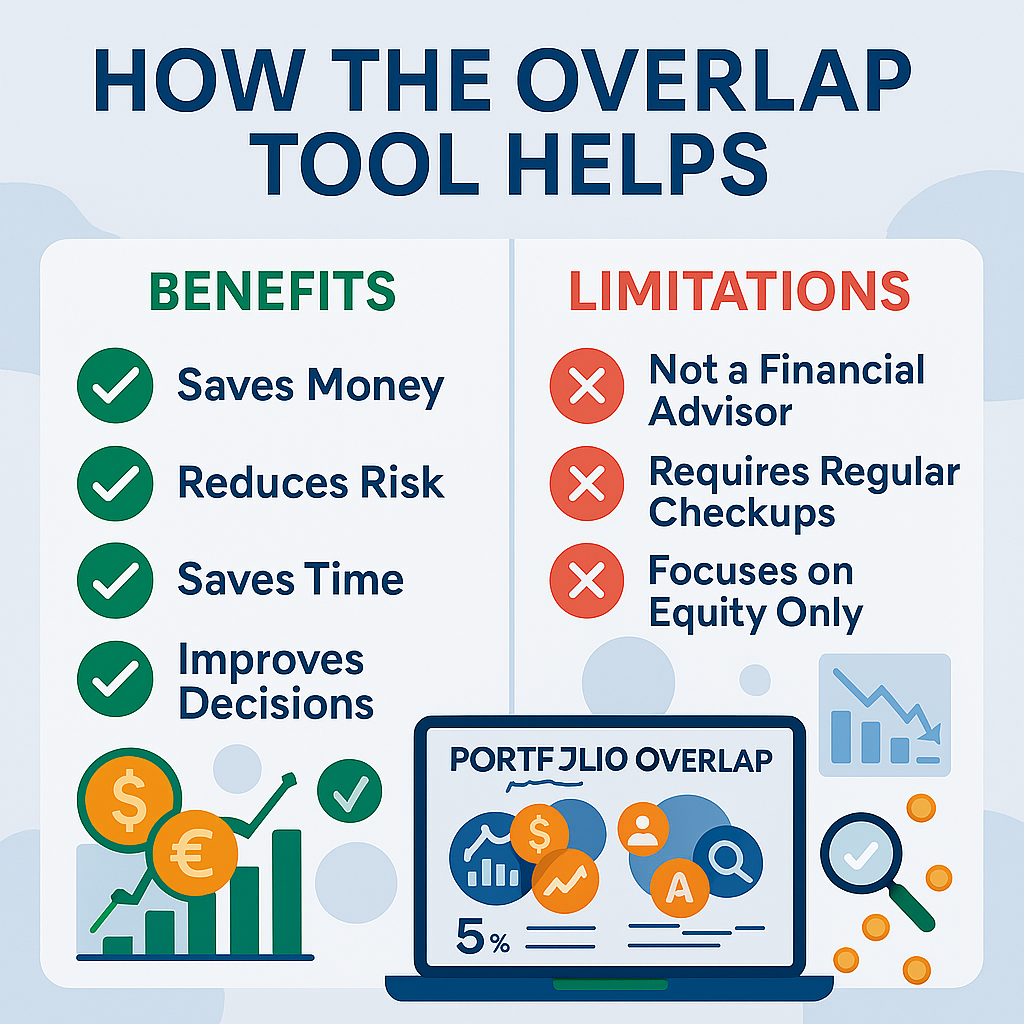

💡 How the Overlap Tool Helps

Benefits:

- ✅ Saves Money by avoiding duplicate fees

- ✅ Reduces Risk by lowering exposure to repeated stocks

- ✅ Saves Time with instant analysis

- ✅ Improves Decisions by revealing actual portfolio concentration

Limitations:

- ❌ It doesn’t replace a certified financial advisor

- 🔄 Requires regular checkups as funds evolve over time

- 📉 Primarily focuses on equity — not other asset classes

- Linkedin : New Post

- Facebook : New Post

🧠 Final Take: Optimize Before It’s Too Late

A high mutual fund overlap can quietly eat away at your portfolio’s performance. By detecting overlaps early and restructuring your holdings, you can:

- Improve diversification

- Minimize unnecessary fees

- Boost your long-term returns

Don’t let portfolio overlap go unnoticed. Take control of your investment journey today.

Linkedin : New Post

Facebook : New Post

👨💼 Need Expert Help with Mutual Fund Analysis or Tax Planning?

Real Tax India is here to simplify your financial journey — from income tax filing to investment optimization. If you’re unsure how your mutual funds are performing or whether you’re diversified enough, our experts can help with data-backed portfolio reviews.

Linkedin : New Post

Facebook : New Post

Comments

Post a Comment