Set Off and Carry Forward of Losses in Income Tax

📉 Set Off and Carry Forward of Losses in Income Tax — A Complete Guide for FY 2025–26

Managing income tax effectively is not just about filing returns; it’s also about strategically handling your profits and losses. One of the smartest tax-saving strategies available to individuals and businesses in India is set-off and carry forward of losses under the Income Tax Act, 1961. These provisions allow taxpayers to reduce their overall tax liability by adjusting losses against taxable income.

Whether you’re a salaried professional, a business owner, or a property investor, understanding how to utilize set-off and carry forward rules can lead to significant tax savings. In this blog, we explain everything you need to know about set-off and carry forward of losses for the Financial Year 2024–25 (Assessment Year 2025–26).

(📊 Discover how to align your mutual fund portfolios with your long-term goals. Read more here : 📝 Are Your Mutual Fund Portfolios Overlapping)

💼 Types of Income & Eligible Losses

The Income Tax Department classifies income under five heads:

- Income from Salary

- Income from House Property

- Profits and Gains from Business or Profession

- Capital Gains (Short-term & Long-term)

- Income from Other Sources

Let’s understand how losses from each category can be set off and carried forward.

(📊 Discover how to align your mutual fund portfolios with your long-term goals. Read more here : 📝 Are Your Mutual Fund Portfolios Overlapping)

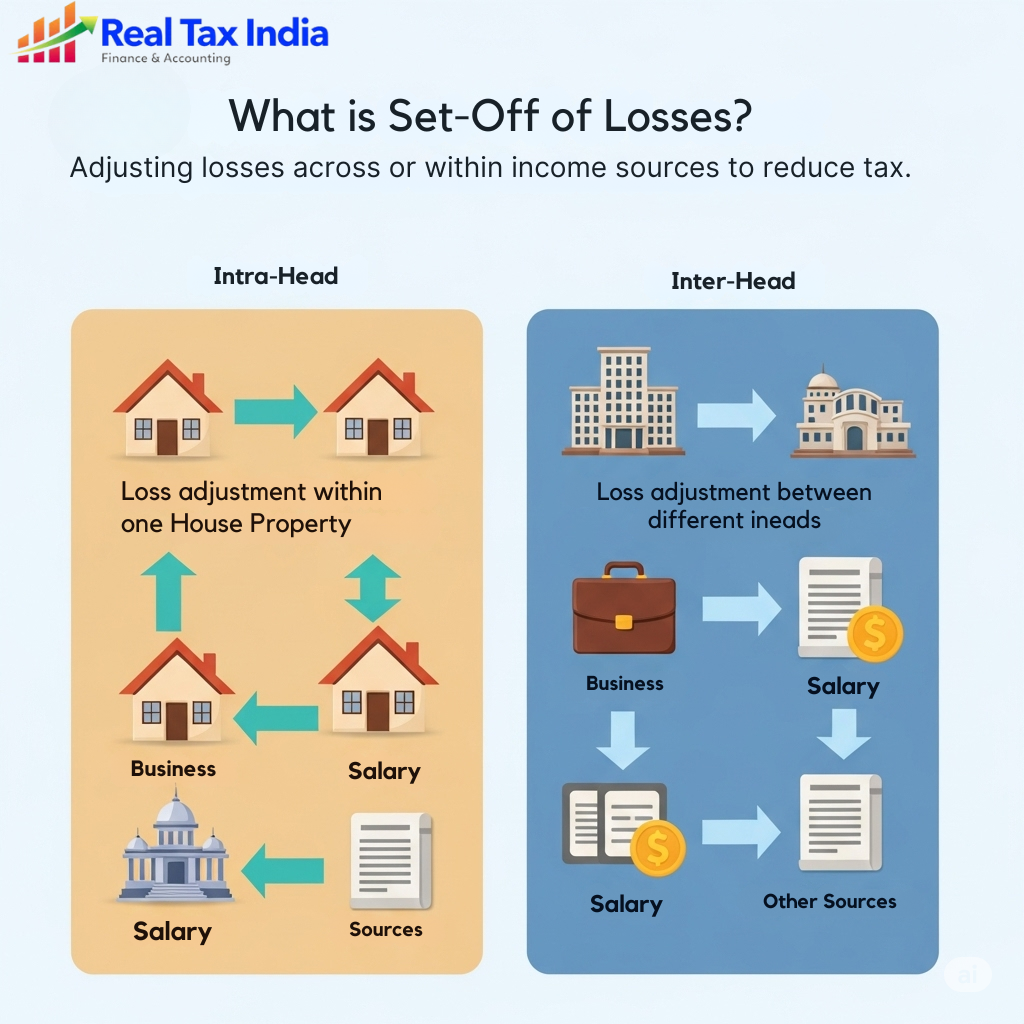

🔁 Intra-Head Set-Off Rules

1️⃣ Salary Income

No losses are permitted in the salary head; hence, no intra-head set-off is possible.

2️⃣ House Property

You can set off losses from one house property (e.g., interest on housing loan) against rental income from another.

3️⃣ Business Income

Losses from one business can be set off against income from another business. But speculative losses, specified business losses, and capital expenditure on scientific research have different rules.

4️⃣ Capital Gains

- Short-term capital loss (STCL) can be set off against STCG or LTCG.

- Long-term capital loss (LTCL) can only be set off against LTCG.

5️⃣ Income from Other Sources

Losses in this category can only be set off against other incomes in the same category.

(📊 Discover how to align your mutual fund portfolios with your long-term goals. Read more here : 📝 Are Your Mutual Fund Portfolios Overlapping)

🔄 Inter-Head Set-Off Rules

Head of Income Can Set Off Against Restrictions House Property Loss Salary, Business, Other Sources Up to ₹2 Lakhs only Business Loss House Property, Other Sources Cannot be set off against Salary Capital Loss Cannot be set off inter-head Only intra-head set-off allowed Other Sources Loss Salary, Business, House Property Except capital gains

⏳ Carry Forward of Losses: FY 2025–26

When losses can’t be fully adjusted in the same year, the Income Tax Act allows carry forward for adjustment in future years. Here are the rules:

🏠 House Property Losses

- Can be carried forward for 8 assessment years

- Can be set off only against income from house property

🧾 Business Losses

- Carried forward for 8 years

- Set off only against business income

- Return must be filed within the due date to carry forward

🎲 Speculative Business Loss

- Can be carried forward for 4 years

- Set off only against speculative income

📉 Capital Loss (STCL & LTCL)

- Carried forward for 8 years

- STCL can be adjusted against STCG & LTCG

- LTCL only against LTCG

(📊 Discover how to align your mutual fund portfolios with your long-term goals. Read more here : 📝 Are Your Mutual Fund Portfolios Overlapping)

📑 Conditions to Claim Carry Forward of Losses

- Income Tax Return (ITR) must be filed on or before the due date.

- Tax audit may be mandatory for businesses exceeding turnover limits.

- Losses should be correctly declared in ITR forms.

- Maintain proper documentation like computation statements, ledgers, and loan interest certificates.

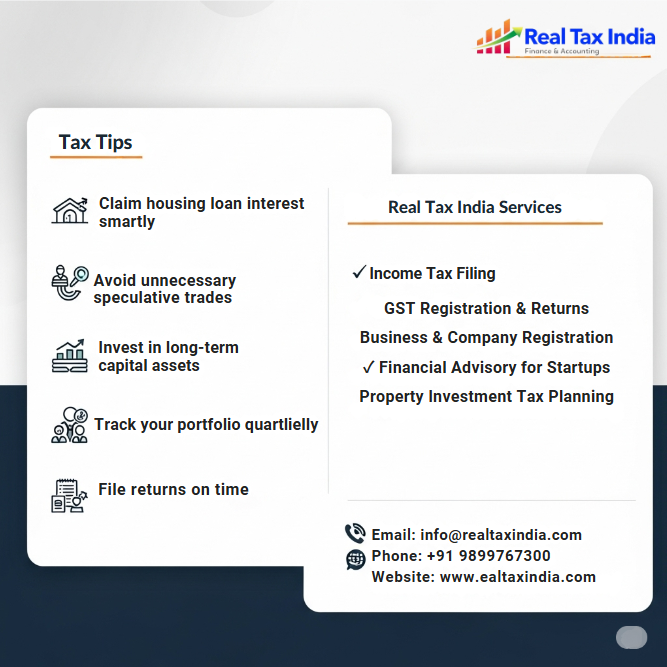

🧠 Pro Tips to Maximize Tax Benefits

- Claim housing loan interest smartly if you have rental and self-occupied properties.

- Avoid unnecessary speculative trades if you are not confident, as their losses are harder to adjust.

- Invest in capital assets with long-term potential to utilize capital losses efficiently.

- Track your portfolio every quarter to align tax strategy.

- File returns on time — delay means you lose the right to carry forward losses.

🌐 Real Tax India — Your Trusted Tax & Investment Advisor

Managing your taxes can be confusing, especially with evolving tax rules. At Real Tax India, we offer expert services to help individuals and businesses optimize their income tax planning.

We provide:

(📊 Discover how to align your mutual fund portfolios with your long-term goals. Read more here : 📝 Are Your Mutual Fund Portfolios Overlapping)

📝 Conclusion

Understanding set-off and carry forward of losses under the Income Tax Act can save you a significant amount in taxes if used correctly. As we move through FY 2023–24, strategic tax planning is more important than ever. Whether it’s a loss from business, capital gains, or property, knowing how to use these provisions wisely ensures that no tax-saving opportunity is wasted.

If you’re looking for expert guidance to manage your taxes, maximize deductions, or file your return without hassle, contact Real Tax India today. We’re here to simplify the complex and help you save better.

Comments

Post a Comment